Let me tell you about what my food spending was like before I learned about proper food budgeting steps and tips. After college, I had NO CLUE what a food budget was and how much money I would need every month to feed myself.

The realization that my Monday-to-Friday Chipotle habit was adding up to $200/month was a seriously rude awakening. Yikes! Perhaps you may have a similar habit somewhere else?

I felt so frustrated that despite being in the privileged position of having graduated without student loans and making a good salary, I still wasn’t saving any money. I was basically in the best place you could be in for saving money, but it just wasn’t happening. For my first six months out of school, I broke even every month.

When you’re new to it, handling your money feels intimidating and scary. I was afraid to look at my credit card statements and figure out where the money was going. When I finally did, I realized that money isn’t something to fear; we can control where it goes. That’s essentially what a budget does!

I was 22 when I started thinking about budgeting, and it was clear where I had to cut back on spending: bar hopping, taxis, clothes, and food. That’s when I first got into meal prep and started keeping track of my grocery budget.

Meal prepping helped me enjoy home-cooked food more than takeout, and after some trial and error, I fell in love with cooking. The savings started to come quickly and easily.

Unlike fixed expenses — rent, utilities, Netflix — a food budget is hard to nail down.

Think about all the factors:

- Where you live (and how much groceries typically cost in your region)

- Your income

- How much you need to eat to be full and satisfied

- Any dietary restrictions/preferences you may have (vegetarian, vegan, gluten-free, etc.)

- Which supermarkets are convenient for you to get to

- How much time you have to cook

- Whether you prefer to cook or dine out/eat take out, and whether to include dining out and takeout in your overall food budget

- Your food priorities (seeking organic or locally sourced food, avoiding a particular ingredient, etc.)

With so many factors to consider, it can be tough to land on a number and stick to it. And it might take some trial and error to get the balance right. And then, even then, sometimes things slip. But that’s ok.

In this post, I want to walk you through the three steps you can take to get a solid idea of how much you can spend on food, and make decisions about how much you should pay for your financial goals.

My original food budget looked something like this:

Groceries: $60/week | $240/mo

Restaurants: $40/week | $160/mo

Takeout: $30/mo (this wasn’t a weekly thing for me)

Coffee: $20/mo

Total: $100/week | $450/mo

I used to include alcohol/bars in my food budget, but since I go out so rarely it’s just part of my “entertainment” budget now.

How does $450/month for a single person in New York City sound to you?

Keep in mind this was my budget when I lived alone in Manhattan, where food is more expensive than other places I’ve ever lived. I also live with my partner now, and we manage to spend $500/month on food together — including restaurants.

I don’t have dietary restrictions, I don’t care about buying organic (my budget would have to be higher), and I eat most of my meals at home. When I do eat out, I don’t go to expensive places. My life is pretty sedentary, so I don’t need to eat as much food as, say, a professional basketball player! I shop at local grocery chains, like Key Foods, not specialty stores, or “health food” stores. If I was willing to travel, I could probably buy cheaper groceries, but I don’t want to spend hours shlepping to different boroughs or riding the subway just to pick up groceries! (I hate the subway. A lot.)

See how all of these factors matter?

I can’t say what the best or most ideal food budget is, because it’s different for everyone. But I CAN help you nail down a budget that’s realistic for you. Let’s start with the most important question/step:

1. How much did you spend last month on food?

This is the easiest way to start nailing down a food budget.

If you use a credit card, you can easily review your food spending over the last month by checking your charges, either in your most recent statement or on your banking app. Just add up every charge from grocery stores, restaurants, and takeout places. You’ll really get to see how often you eat out vs. grocery shop, and how the two compare cost-wise.

If you don’t use a credit card, I recommend tracking your food spending (restaurants and grocery trips) for at least two weeks starting today — preferably weeks that are “normal” when you’re not traveling or hosting. You can double that amount and get a feel for how much you’re currently spending per month. You can keep the receipts or track the costs in a journal or the notes app on your phone.

A budgeting app, like Mint (that’s what I use), makes it easier to get these totals if your cards are connected. However, you should make sure to double-check, because budgeting apps can sometimes mislabel your charges.

If you’re looking for more budgeting tips, click here to get my list of 12 ways to cut down your grocery bill on your next shopping trip!

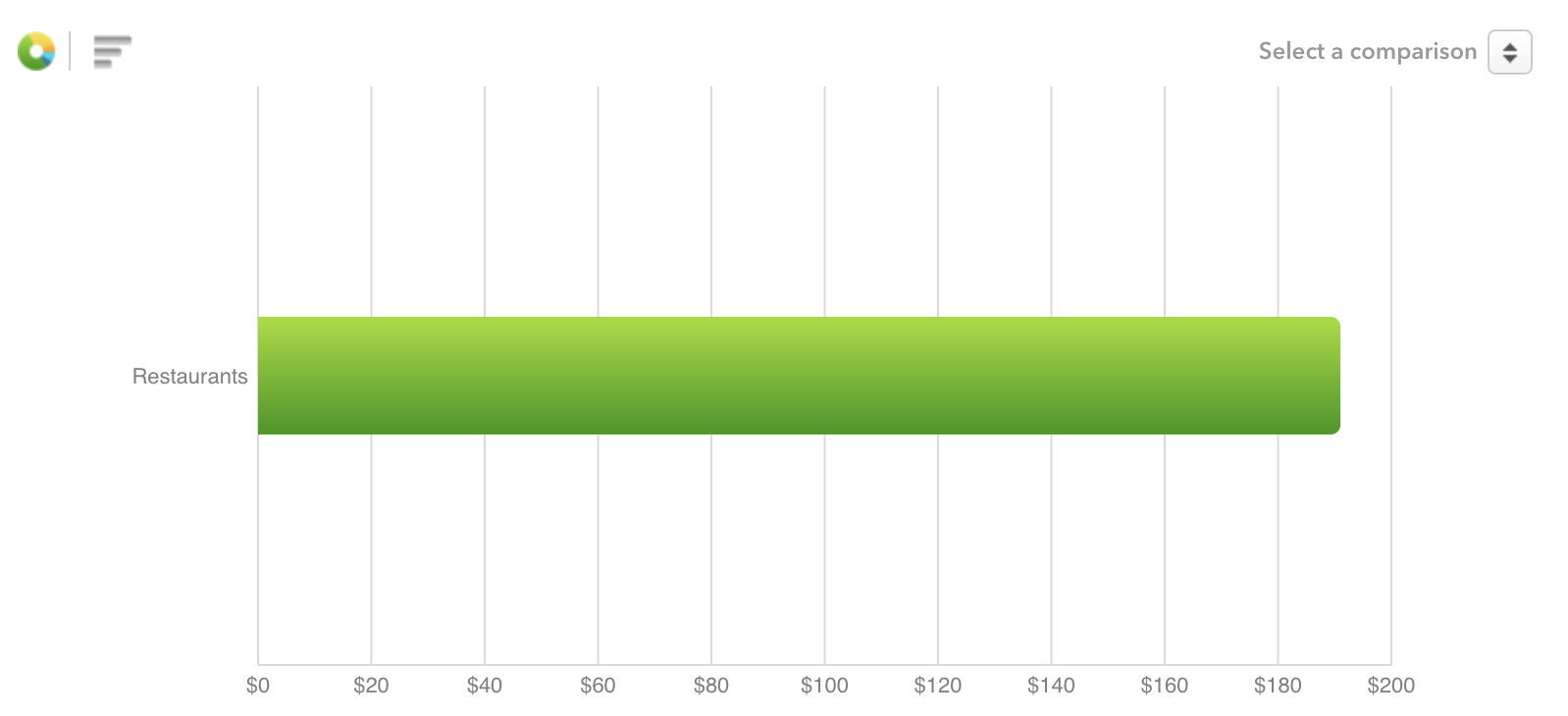

Here’s my restaurant spending from last month, according to Mint. Definitely on the higher side, since I took my mom and my boyfriend out to dinner for their birthdays!

It might mean shopping at different stores, cooking more (I can help you with that!), or changing your overall grocery shopping strategy.

If you want to learn how to shave $20 off your next grocery trip, sign-up for Workweek Lunch’s 7-day free trial, which includes my free grocery guide, and learn all my tips!

2. Test different weekly budgets to find out what’s realistic.

Now that you know how much you spend without trying to cut back, decide how much you want to spend. Be realistic, and you can start small — if you spent $600 on food last month, suddenly cutting it to $300 probably isn’t going to work.

The best way to locate the happy medium between “lean, but comfortable” and “completely unrealistic” is to test different budgets each week.

If you’re currently spending $200/week, try to cut it back to $150 for the next week. If that’s easy, try $100/week. See how much you can cut without feeling a loss or struggling to stay within the budget.

You’ll quickly find out what’s doable for you and what’s not. This is exactly what I did when trying to cut back on food spending, and it worked well! Instead of dramatically cutting back, do it in steps.

Within three or four weeks, you’ll find your conscious comfort zone.

Here are some budget-friendly resources that will help you cut back on how much you’re spending:

- These recipes are ideal for anyone without easy access to a microwave and they each cost less than $2 per serving, and they actually taste good!

- Making cold brew coffee has become part of our meal prep routine. Like batch cooking, making a big batch of coffee each week has saved us time, money and we’ve significantly reduced waste. Learn how we save over $150 per month by making cold brew coffee.

- According to the USDA Americans waste around $370 a year on groceries. Reduce your food waste and save money by learning how to make a grocery list and avoid over shopping.

3. Track your spending with an app or cash envelopes.

It’s fairly easy to SET a budget. Sticking to it is the hard part!

Before I started seriously budgeting, I NEVER looked at credit card statements or the Mint app (even though I had been “using” it for years). The most important habit you have to form to be able to stick to your grocery budget is to consistently check and track your spending.

If you’re not into using credit cards or budgeting apps, cash envelopes are a popular way to go. Once you’ve determined your food budget, you take out that amount of cash for the month or the week, and use it for whatever you’ve set a budget for — in this case, food. I haven’t done this before, but it’s really useful! Once you’re out of cash, that’s it.

Just remember, these are things to TRY. One of these methods might not work for you, but you won’t know that until you test different ways to track your spending. You don’t have to commit to any of this long-term! Treat it like an experiment.

More budgeting apps you can try:

You can set a budget, and the app will alert you when you’re close to hitting it or if you go over it. But here are some other popular options:

- YNAB (You Need a Budget) — After the 34-day free trial, YNAB comes at a cost, but for the app’s devotees, it’s well worth it. It forces users to spend within their actual income and is known for helping people pay down debt.

- Wally — Wally is free, and it’s one of the best out there for easily tracking your expenses, especially if you use a mix of cash and cards for food. Not only can you connect your various accounts, but you can also take photos of your receipts, and Wally will automatically add that info.

- Tiller — If you love a spreadsheet, Tiller might be for you. It does include a cost after the 30-day trial, but it’s less than YNAB. It imports all of your spending into either Google Sheets or Microsoft Excel, and gives you templates for tracking your spending, visualizing, and budgeting, but it also allows you to use the data in whatever way works best for you.

- Pennies — Pennies has a one-time cost of $3.99, and is a great one for freelancers who don’t have a consistent bi-monthly paycheck coming in. It allows for flexibility while still keeping careful track of what you spend and where you spend it. Plus, it allows for any currency!

- Goodbudget — If you like the idea of the envelope system but don’t actually want to use envelopes, you are Goodbudget’s target audience. They offer a free plan and a premium plan, and the app basically separates your monthly income into digital “envelopes.” It does require more discipline than a physical envelope would, but if you have that discipline, it might be perfect for you.

LITTLE THINGS YOU CAN DO TO SAVE MONEY ON FOOD

Creating your food budget is the main solution to saving money on groceries. But there are also changes you can make to your lifestyle and habits to help you save more. Here are a few tips.

1. Eat out less

Going to restaurants with friends is fun, but they can also add quite a lot to your expenses. This isn’t the most appealing way to save money, but you don’t have to start refusing every invitation to eat out.

Socializing is still important. If being able to eat out with friends is a non-negotiable for you, you just need to allocate part of your food budget to it.

2. Add variety to your meals

It will be hard to avoid eating out if you eat the same meals every day or week. Learning a few recipes and trying out new ingredients can be a fun, productive way to balance your grocery budget and spice up your meal prep. It will definitely help prevent boredom!

3. Bring lunch to work

You can save quite a lot simply by packing your own food and bringing it to work. Make easy snacks like sandwiches if you have little time to prepare. This also helps you avoid fast food.

4. Use your leftovers

You can lose a lot of money from wasting leftovers. Using them as ingredients in different dishes also lets you do the previous two tips at once. You’ll save money and possibly find a new way of cooking it. You can even deliberately make leftovers. Just be sure to account for this when making your food budget.

5. Buy food seasonally

Seasonal fruits and vegetables are cheaper and tastier. Buying specific food at the right time of the year can save you a lot of money and make for more flavorful meals.

6. Make fewer but bigger trips to the grocery

The more you shop, the more often you’re exposing yourself to the temptation of buying more than you need. One way you can do this is by buying products that have long shelf lives in bulk. Budgeting groceries is partly about learning self-control.

7. Do grocery shopping on a full stomach

Continuing with another tip on self-control, you’re more likely to make impulse buys when you’re hungry. Go grocery shopping after a meal. If that’s not possible, have a quick snack with a good amount of protein and carbs to keep you feeling full and not be distracted at the store.

Follow these tips, and you’ll be surprised at how much less you’re spending on food.

Are you ready to start saving money on groceries?

If you know you’d like to cut back on food spending, using a food budget will help you get closer to your financial goals, whether it’s paying off student loans or buying a house in seven years.

For me, it’s been instrumental in building an emergency fund and saving money for snowboarding, which is my one true passion in life (and a costly hobby). Having a goal in mind, whether it’s one super-specific trip you want to go on or a more nebulous idea of what you want your life to look like, can help motivate you to stick to the budget you’ve set.

Now you know how to create a food budget. All that’s left is sticking to it.

Meal prepping can help you save money on groceries and stick to your food budget!

Sign-up for a 7-day free trial and includes my free grocery guide!

Leave a Reply